Loan app without CRB check in kenya and how to get CRB clearance

It’s another month, another year, and everyone is looking for a Loan app without CRB check in Kenya and how to get CRB clearance. A lot of Kenyans has been in CRB for some years now for failing to pay their outstanding loans from apps like Tala KCB loan and Mshwari. The deal was so good at first little did they know after failing to pay they will be listed by CRB Kenya.

What is CRB?

This is a firm that shares and provide information about consumer credit and shares it with the different institution if needs arise. CRB in full means credit reference bureau. If a particular loan lending company wants to give a loan to someone, they first check whether you are listed by CRB. If so, they deny you a loan until you clear your name from CRB.

CRB listing

This is the credit information about an individual whether positive or negative. If you owe a loan to a particular loan lending firm and you fail to pay as agreed, then the lending institution will report you to a credit reference bureau that will list you. After being listed, you won’t be able to get a loan from other different firms.

How to get clearance from CRB

For you to be listed on CRB, you are given about 30 for mobile lenders to 90 days for a bank to list you on CRB. This is after you fail to pay the loan on the agreed date. After listed you will be blacklisted but not forever since you can get Cleared from CRB as I will explain in a few. If you have ever requested a loan from the Mobile app, you will agree with me that you will be required to fill in all your information including your full names, email, I.D, and your phone number. This means the lending institution got all your information and they know how to get you.

To be cleared, you need to pay your outstanding loan first before the firm requests CRB to unlist you. It will take about 3 days to be cleared from CRB. This is after the lending company whether Okash, Tala, Mshwari has sent a request to the credit reference bureau to clear you from the list. It does not mean after being cleared from the CRB list, your name will be delated to CRB, your name will just change status from Negative to positive. The name will remain there for the next 5 years so that any lending institution e.g a bank can be able to follow up on your loan payment history.

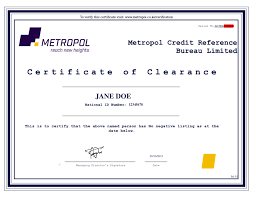

CRB clearance certificate

Some companies before employing you they may ask about a CRB clearance certificate. The reason for this is to make sure you are not listed in CRB and your credit record is positive. To get a CRB clearance certificate you are required to pay Kshs. 2,200 which is referred to as a processing fee.

Point to follow to get a CRB clearance

- Contact any CRB company of your choice.

- The company will send a form via online which you will be required to fill.

- As I said, you will be required to pay a processing fee of 2,200

- Wait for a few for the processing and if you got no outstanding loan then you will be issued a CRB clearance certificate.

Loan app without CRB check in Kenya

Although this is one of the important aspects before lending someone a loan, There is a number of apps that don’t care whether you are listed by CRB or not. Those types of apps use your phone details like your mobile phone serial number and location as their security. The list includes

- Kano loan app

- Tunzi loan app which was formerly known as utunzi

- Upazi loan app

- Utajiri loan app

- Craft loan app

- Dolax loan app

I hope this article was useful to you and now you got the Loan app without CRB check in Kenya and how to get CRB clearance.

(you can also read how to apply for a smart driving license)