Deadline for filing tax returns – How to file KRA iTax returns

After every year, all Kenyan taxpayers are requested to file their tax returns. I know a lot of people would like to know the Deadline for filing tax returns – How to file KRA iTax returns. The filing should be done every year between 1st January to 30th June. Failure to that you may be required to pay fines which is not less than 1000/=. Kenya revenue authority every year reminds the employers to release p9 form which allows the employees to file their tax returns.

How to file Tax Returns in kenya.

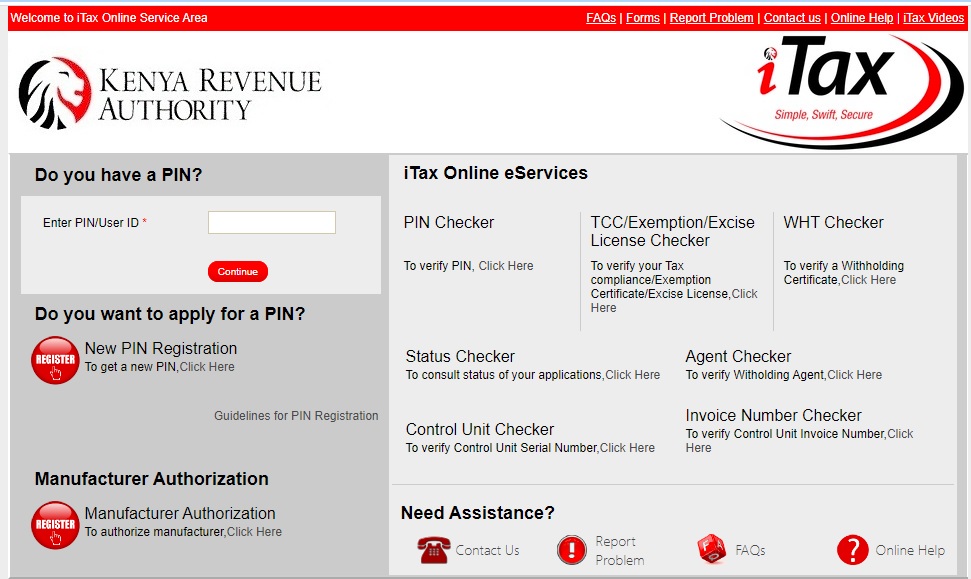

The whole process is done online by login to the Kenya revenue authority site, Itax.kra.go.ke. The online portal has made it simple, remember before this portal people used visit Kenya revenue offices. Sometime you could have spent almost whole day in those offices due to the long ques. If your are a Kenyan and you have KRA pin, you must file returns every financial year. This means whether employed or not. If you are not employed, you should file Nil tax returns. The filing return system is designed in such a way that you can choose the kind of business you are operating. This may be either, Individual, Cooparate or partnership. You must be careful while choosing the categories provided since each category has different rate.

How to file tax returns online

Whether you are running a business as an individual, partnership or cooperative, the process looks the same. The only difference is the details you are supposed to fill. To file tax returns online you need to follow the steps provided here;

- As I said before, you need to visit KRA tax returns online portal Itax.kra.go.ke.

- you need to login by providing your pin and password.

- You will required to select e-returns on the provided menu then select “File returns

- Now you need to select the tax obligation to you by first filling your KRA pin. After that, simply click next

- Now the portal will open a form which you are supposed to fill based on the tax obligation you selected

- You will be provided with a link to download the form which will open with Excel. You can now open the downloaded form, fill the necessary field and save it to your laptop or computer.

- In the itax portal select the period of files return

- macros should be enabled to allow your file to be zipped

- You can now upload your file and don’t forget to agree with terms and conditions provided by marking the box provided.

- Finaly submit by clicking “submit button”. By so doing the file will be uploaded then click ok if a pop up message ask if you want to upload the file

After the doing those processes, a receipt will be generated with a message; Submission successful “. That is how and easy to file KRA iTax returns in kenya

Read also ( How to pay electricity token using mpesa)